This is gambling, not investing.

– Brett Arends in an opinion piece on MarketWatch called ‘An open letter to the GameStop army on Reddit’

There has been a ferocious tug-of-war happening on the US stock market with the shares of a company called GameStop.

Let’s set the scene first.

GameStop is an American video game, consumer electronics & gaming merchandise retailer. They closed 1,000 stores last year and seems destined to go out of business altogether in a year or two. (Computer games are, in general, no longer sold as physical items that can be resold second-hand. Game players buy & download their games from the web).

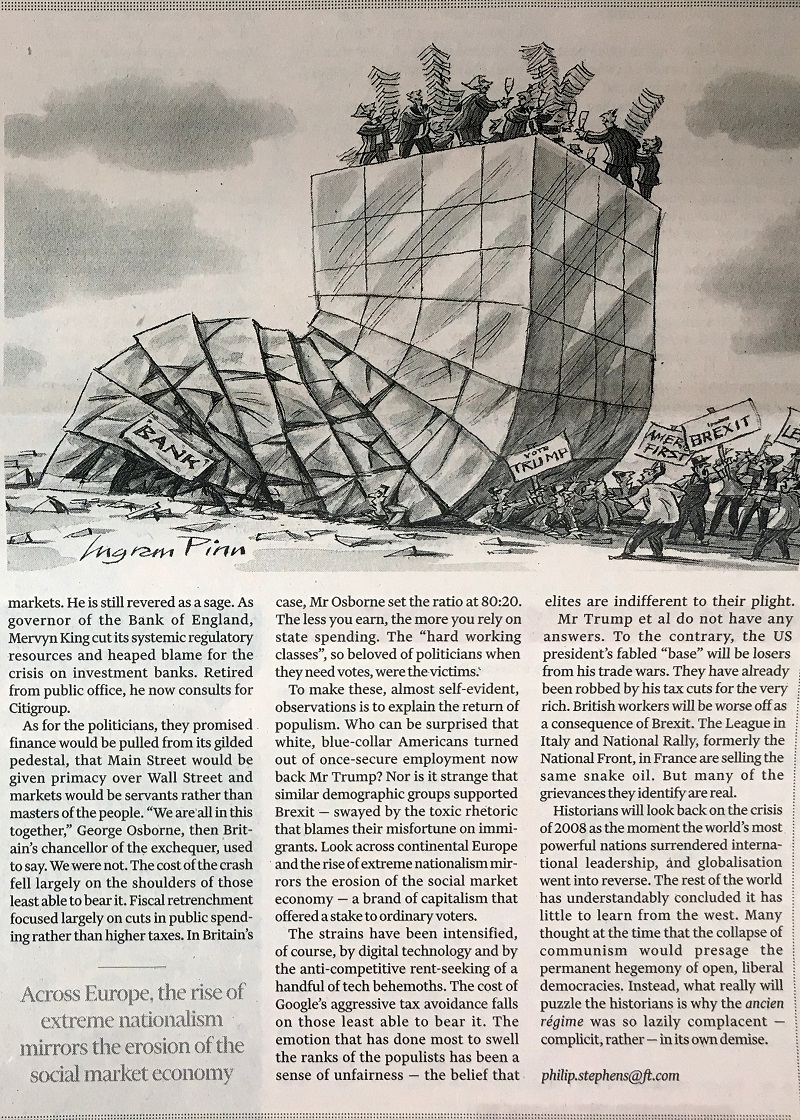

Hedge funds are for billionaires and wealthy investors, and their managers like to use derivative instruments to make ungodly sums of money for their clients (and sometimes ungodly losses). One such instrument is short selling. The investor (hedge fund) borrows shares from a broker, sells it into the market. The investor has to buy back these shares at a future date. So the investor hopes/ believes the share price will fall. (That way the investor pockets the difference). If the share price ends up higher at the future date, the investor will be forced to buy it back at the higher price, and lose money/ lose a LOT of money.

Robinhood is a financial services start-up with an app that makes it super-easy for individual investors to buy and sell shares, at zero commissions (free). Critics charge that they make transacting too easy, and that they lure young and first-time investors into day-trading, instead of long-term investing.

Enter social news aggregation, web content rating, and discussion website Reddit.

Enter social news aggregation, web content rating, and discussion website Reddit.

The community members from reddit.com/r/wallstreetbets/ want to flip off the hedge fund managers and help the little guy to make money. One of the ways to do this recently, has been to pile into GameStop shares. If large enough numbers of investors (‘investors’?) ignore the sage advice from Yahoo Finance that a stock is overvalued, and buy it anyway, things start to happen.

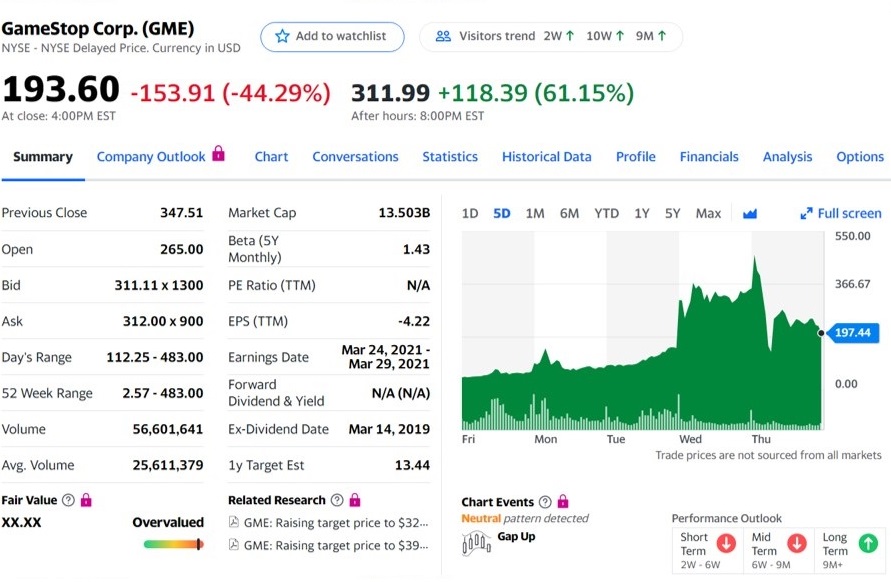

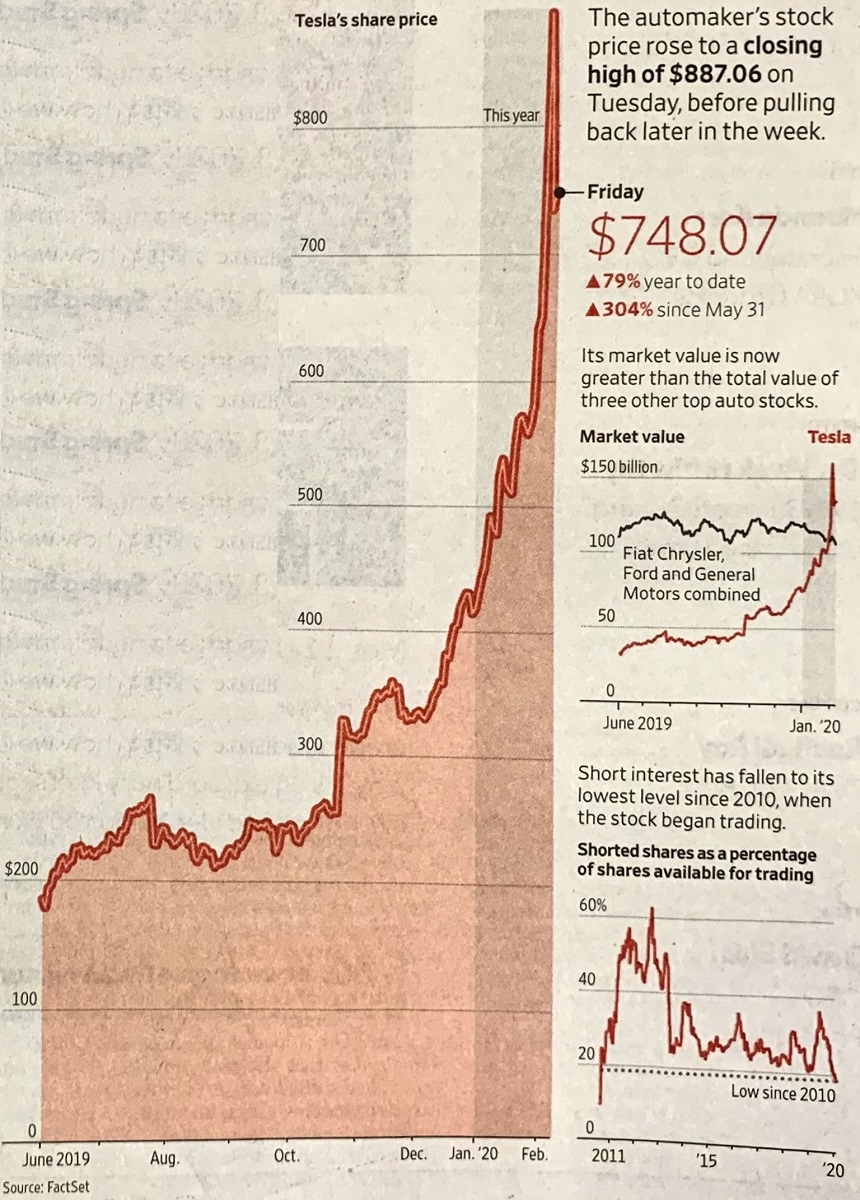

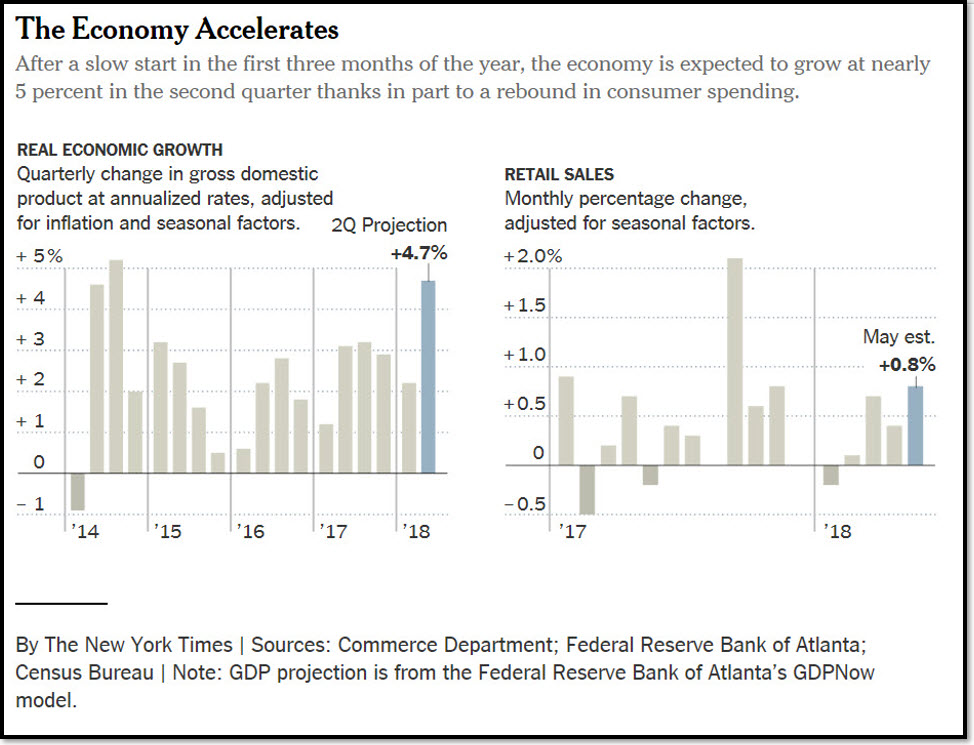

GameStop was sort of left for dead by July 2020 ($4), but then came Jan 1, 2021 ($18), and when more short-sellers had to jump in this week and start to buy GameStop in a classic ‘short squeeze’. The demand pushed the price up to $468 at 9.45am this morning. That’s a 100-fold increase from six months ago.

By today, hedge funds are said to have lost at least US$5bn. On the other side are people such as a Texas fifth-grader that cashed in the 10 GameStop shares his mom gave him for Kwanzaa, on Wednesday — for almost $3,200. She had bought them for $6 apiece as a holiday gift in 2019.

Robinhood jumped in and blocked its investors from buying GameStop today. I’d say that is interfering with the free market. Google removed over 100,000 one-star reviews of the Robinhood app on Google’s Play Store, to restore its 4-star rating. I’d say that is interfering of some kind. Billionaire Leon Cooperman was on CNBC again today, saying he doesn’t fault the wallstreetbets investors, but that this would end in tears. (Yes, it would for some, but not for everyone). Cooperman reiterated his position that rich people shouldn’t pay more taxes.

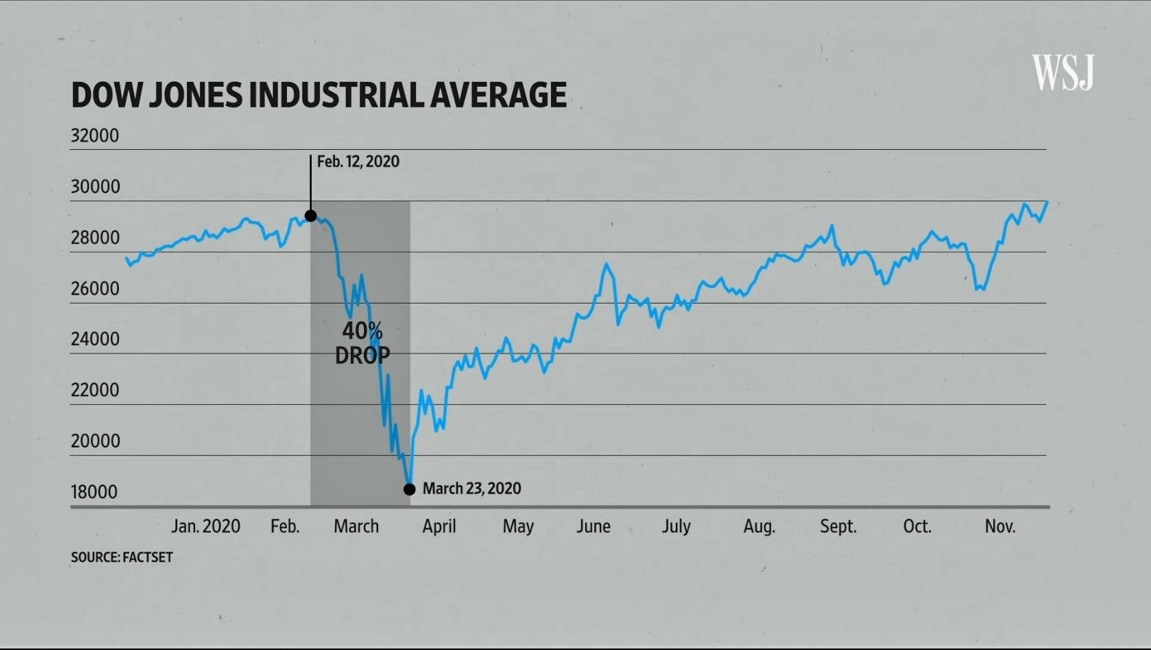

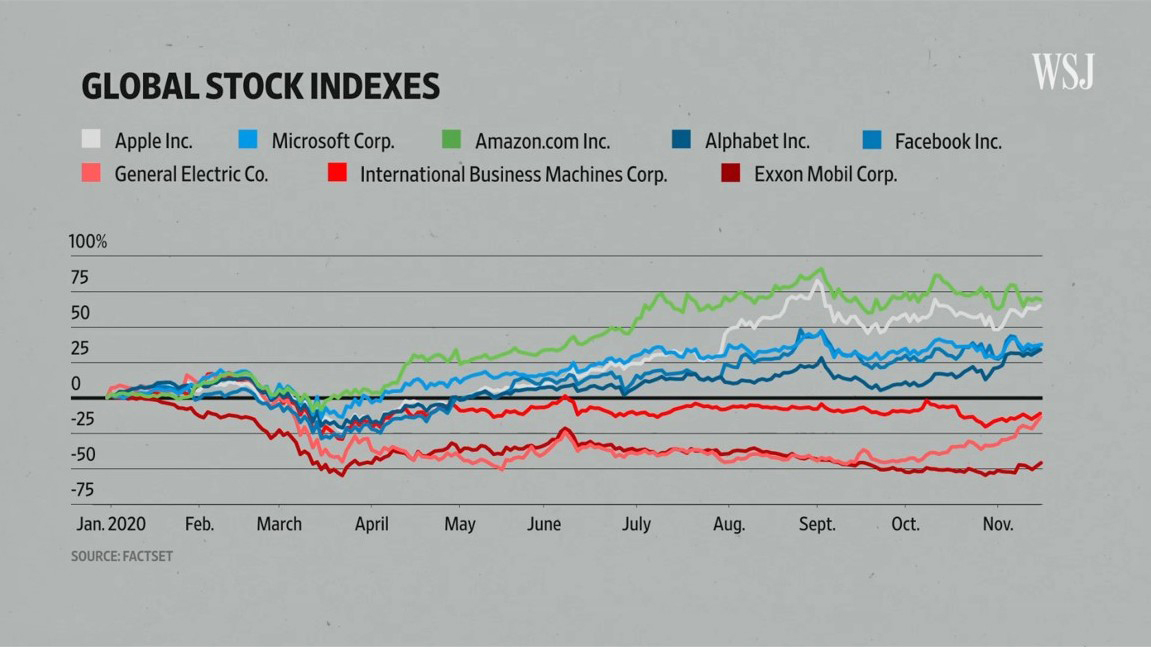

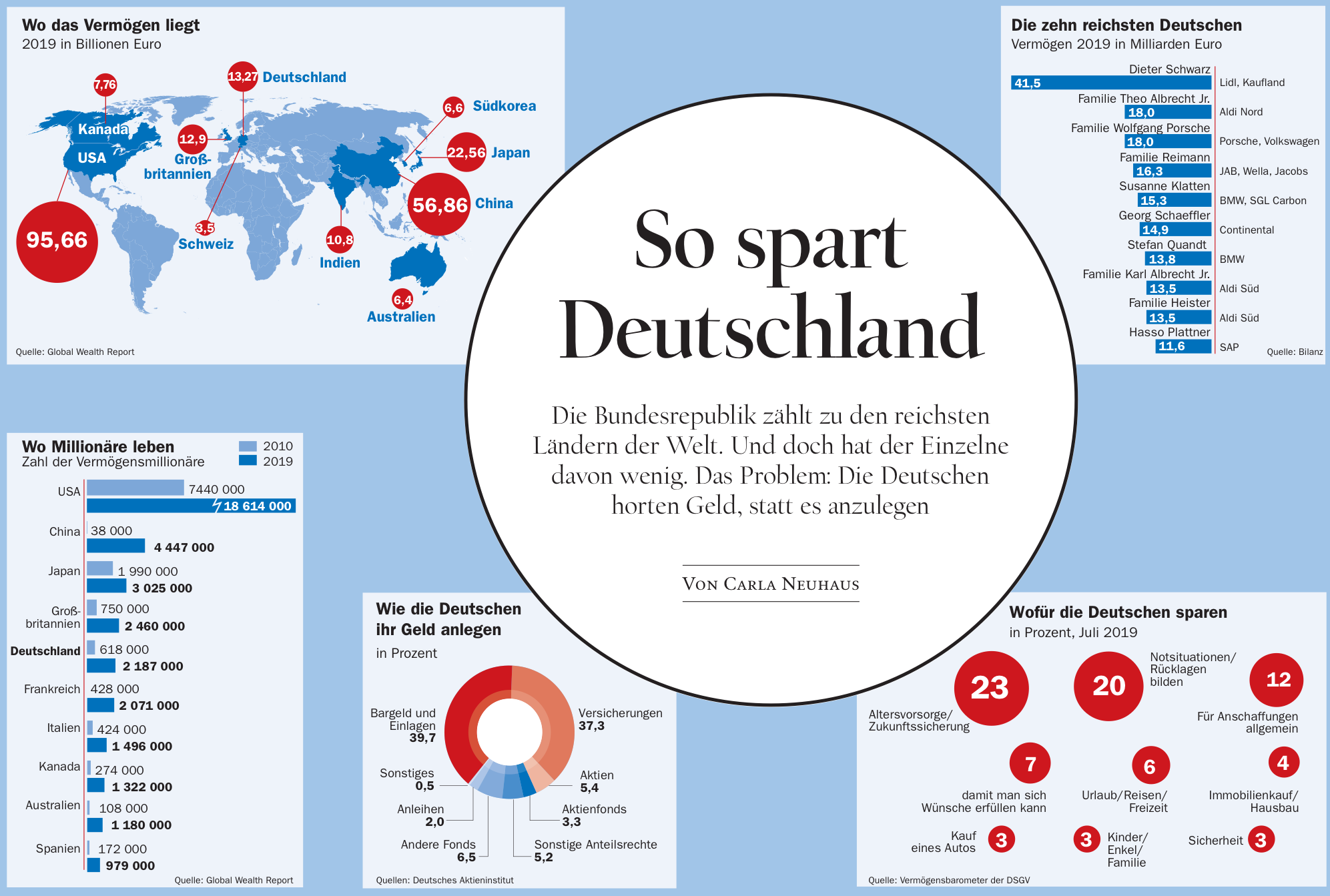

All this is happening against the backdrop of a deadly pandemic, that has devastated the economy & magnified inequalities ten-fold. The federal government is pushing trillions of dollars of stimulus into the economy, with hundreds of billions going to undeserving companies and individuals.

So exactly how free is this economy, this market, and who on Wall Street, is manipulating whom?