Another Monday, and another big down day in the US stock market.

The latest is that Trump is threatening to fire Fed chair Jerome Powell. (Can he do that? Powell, has repeatedly stressed that his firing is not permitted by law, but I don’t think that will stop Trump).

Here are excerpts from Heather Long’s opinion piece in the Washington Post, titled ‘There’s only one way the U.S. avoids a recession”

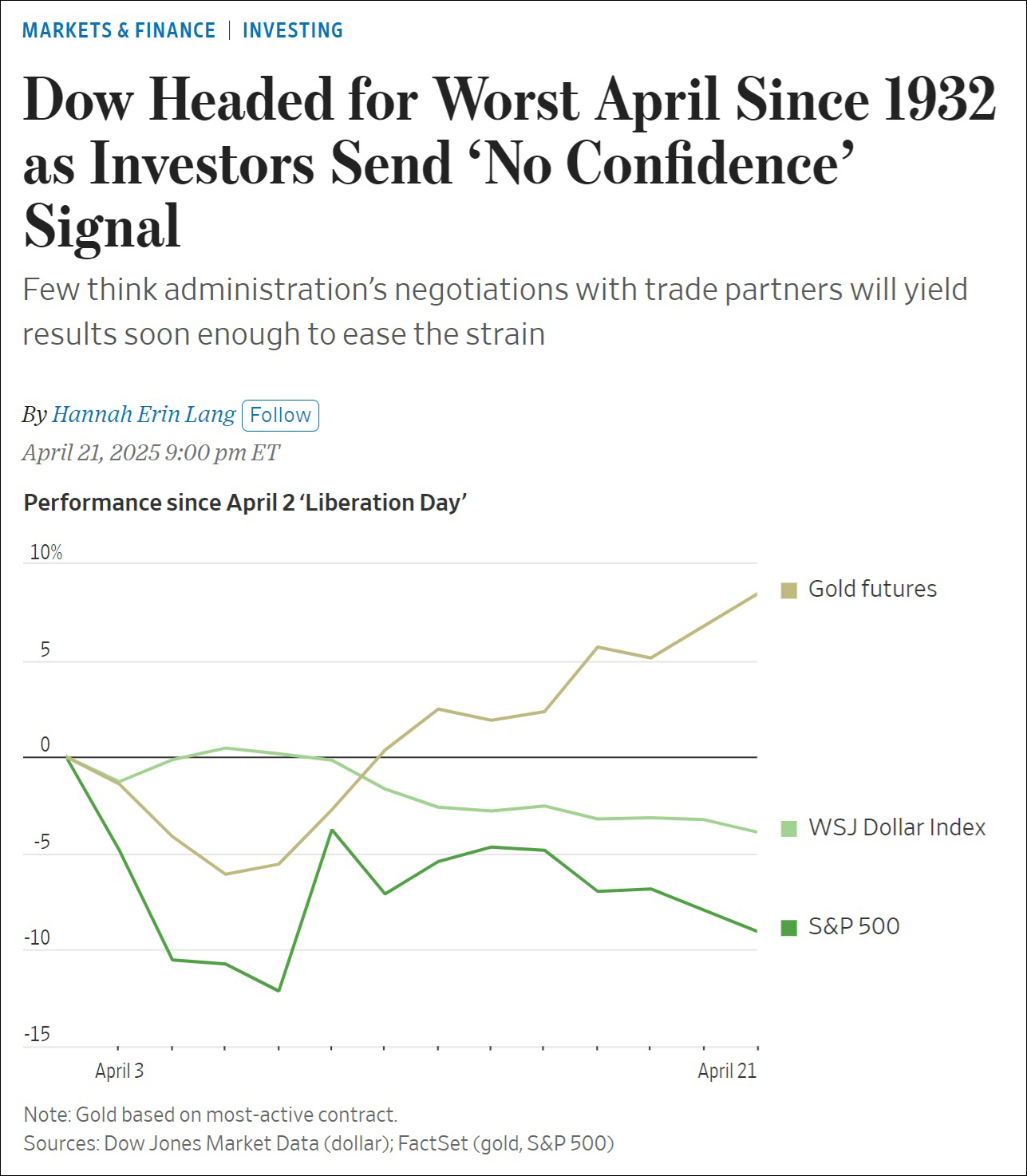

The alarming signs just keep coming since President Donald Trump announced massive global tariffs on “Liberation Day.” The price of gold has soared to an all-time high as people rush for the ultimate safe asset. The U.S. dollar has tanked to a three-year low as investors would rather own about anything that isn’t American. As if the tariff chaos wasn’t enough, Trump is also threatening to “terminate” Federal Reserve Chair Jerome H. Powell, one of the only trusted economic leaders the nation still has.

…

The United States is probably not in a recession today, but it’s looking inevitable that it will be soon unless the White House dramatically shifts on trade. There’s only one way the U.S. avoids a recession: if Trump stops the tariff madness.

Trump has ushered in an economy of distress, even among the rich. His tariffs are the highest since the Great Depression. Americans are terrified that prices are going to spike again, and they might lose their jobs. Businesses are equally alarmed and entering an almost-comatose state as they wait to see what happens with trade, budget cuts and taxes. Traffic at the Port of Los Angeles, the major hub for Asian imports, has dried up so much it resembles early covid days.

…

“I think we’re going into a recession,” said Neil Dutta, head of economic research at Renaissance Macro Research. “What’s the upside case for the economy? Even if we go back to where we were before the trade stuff and Trump just declares victory, so much damage is done, it’s hard to undo.”

There’s no safety net left to stop a downturn. The Fed isn’t going to come to the rescue and cut interest rates to prop up the economy because there’s too much concern about inflation returning. Trump is slashing government spending, especially on many areas that help the poor. Congress isn’t going to do a big stimulus package with “stimulus checks” for most Americans as it did during the pandemic. Meanwhile, consumers no longer have a ton of savings to cushion price hikes or job losses as they did coming out of covid. And the bond market freak-out has only made it more difficult — and expensive — for anyone trying to refinance their loans.

If layoffs really start to pick up, consumer spending will nosedive and a downturn is almost certain. Already, there’s been a surge in Americans who are paying the bare minimum on their monthly credit card bills — an early sign of widespread distress. The number of “minimum payers” is at a 12-year high, according to the Philadelphia Fed.