The classic example of a soft landing is the monetary tightening conducted under Alan Greenspan in the mid-1990s. In early 1994, the economy was approaching its third year of recovery following the 1990-91 recession. By February 1994, the unemployment rate was falling rapidly, down from 7.8% to 6.6%. CPI inflation sat at 2.8%, and the federal funds rate sat at around 3%. With the economy growing and unemployment shrinking rapidly, the Fed was concerned about a potential pick-up of inflation and decided to raise rates preemptively. During 1994, the Fed raised rates seven times, doubling the federal funds rate from 3% to 6%. It then cut its key interest rate, the federal funds rate, three times in 1995 when it saw the economy softening more than required to keep inflation from rising.

– Sam Boocker and David Wessel writing for Brookings.edu, Sept. 14, 2023

They all turned out to be wrong— those economists and money managers that opined a year ago that we would have a recession here in the United States by now.

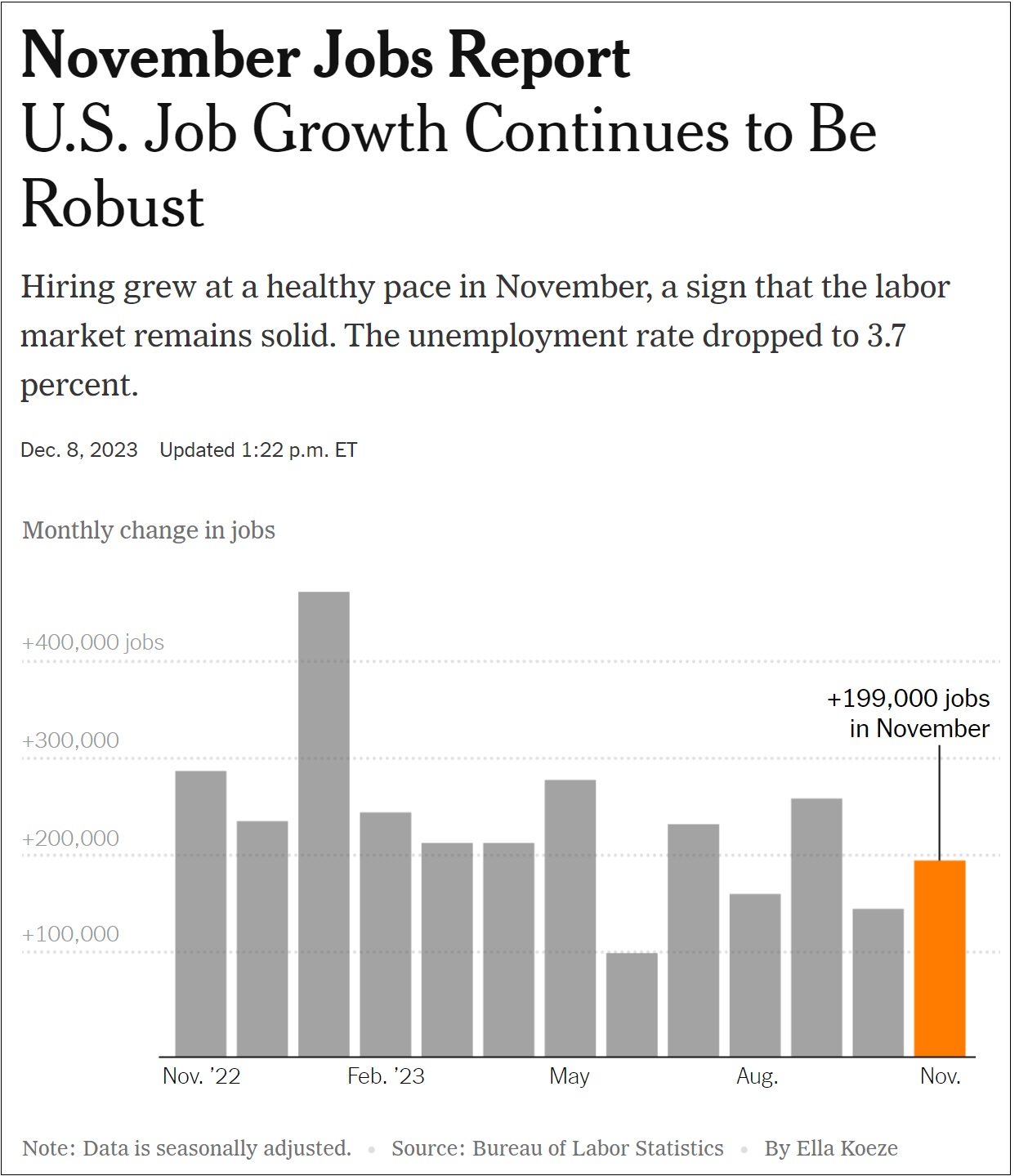

The year is almost out, and jobs are still being added to the economy.

Employers added 199,000 jobs last month, the Labor Department reported Friday, while the unemployment rate dropped to 3.7%, from 3.9%.

The increase in employment includes tens of thousands of autoworkers and actors who returned to their jobs after strikes, and others in related businesses that had been stalled by the walkouts, meaning underlying job growth is slightly weaker.