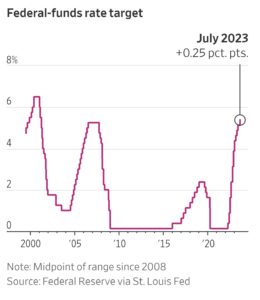

The Federal Reserve raised the federal funds rate by a quarter percent today, to a range of 5.0-5.25%.

From the Wall Street Journal:

Powell didn’t rule out another rate rise at the central bank’s September meeting, but he emphasized how much the central bank had already done along with the amount of time it can take for monetary policy to cool inflation.

“We’ve come a long way. Inflation repeatedly has proved stronger than we and other forecasters have expected, and at some point that may change,” Powell said. “We have to be ready to follow the data, and given how far we’ve come, we can afford to be a little patient, as well as resolute, as we let this unfold.”

Fed officials have been concerned that underlying price pressures may prove more persistent as a solid labor market allows workers to bargain for higher pay, making it harder to get inflation down further.