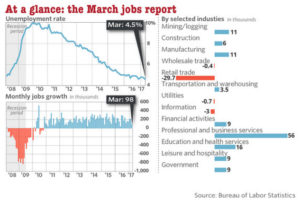

The number of jobs added to the US economy in March was only 98,000 – far fewer than the 185,000 estimate. Weirdly, the unofficial unemployment rate went down to 4.5%, the lowest in 10 years (meaning more people had given up looking for work?). Hourly wages only rose 0.2% (in a strong economy this number would be 3% or even 4%).

The number of jobs added to the US economy in March was only 98,000 – far fewer than the 185,000 estimate. Weirdly, the unofficial unemployment rate went down to 4.5%, the lowest in 10 years (meaning more people had given up looking for work?). Hourly wages only rose 0.2% (in a strong economy this number would be 3% or even 4%).

The Federal Reserve Bank will probably keep raising the federal funds rate, to allow them more room to maneuver for the next recession. There is so much talk of raising the rates – or not – at each Federal Reserve Meeting, that I had to look up the recent history of the rate (see below). It’s still very low by historical standards (the rate is now 0.75 to 1.00 %):

Dec 16, 2008 target rate set to 0.0–0.25

Dec 16, 2015 — 0.25-0.50

Dec 14, 2016 — 0.50-0.75

Mar 15, 2017 — 0.75-1.00