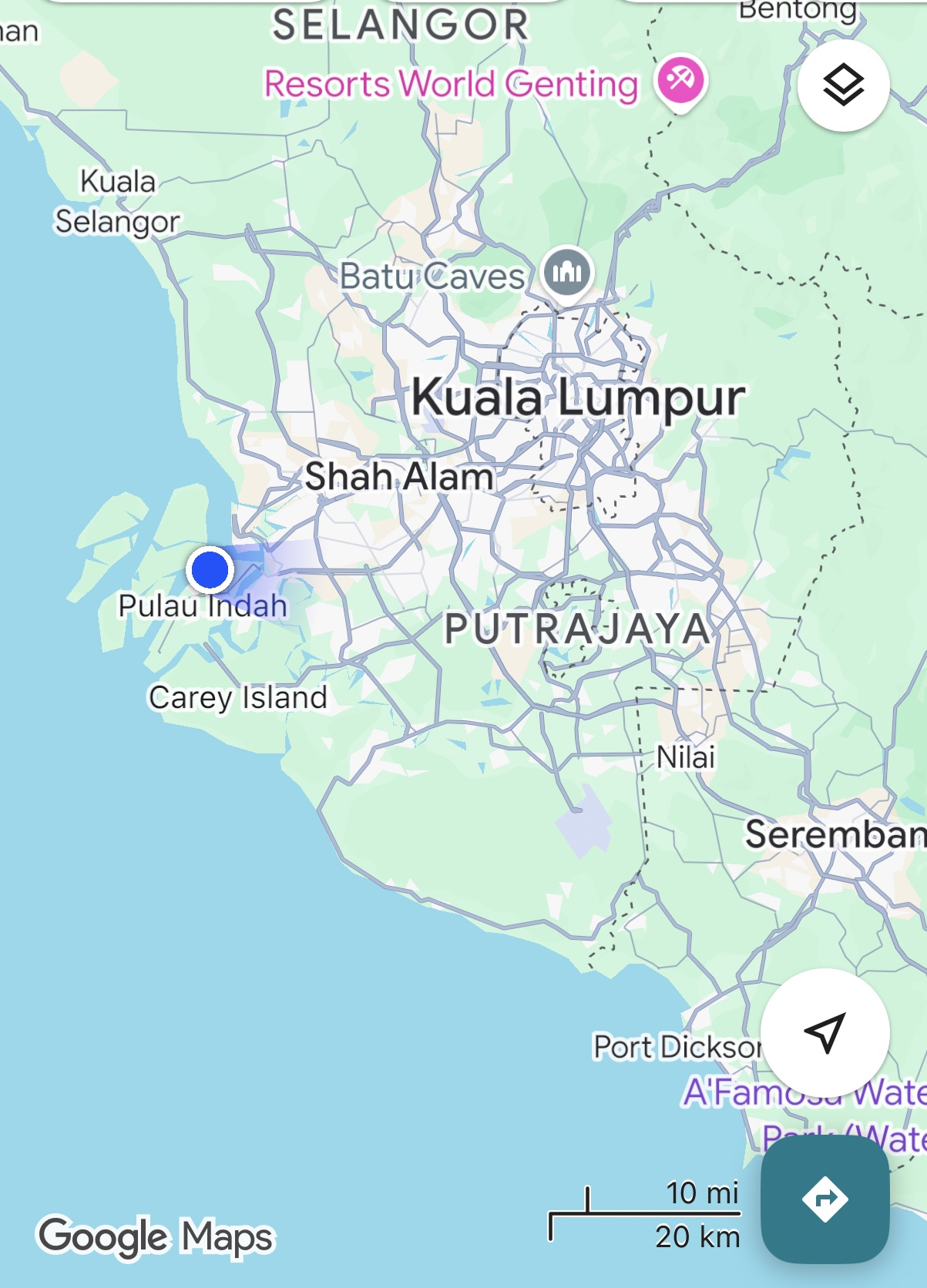

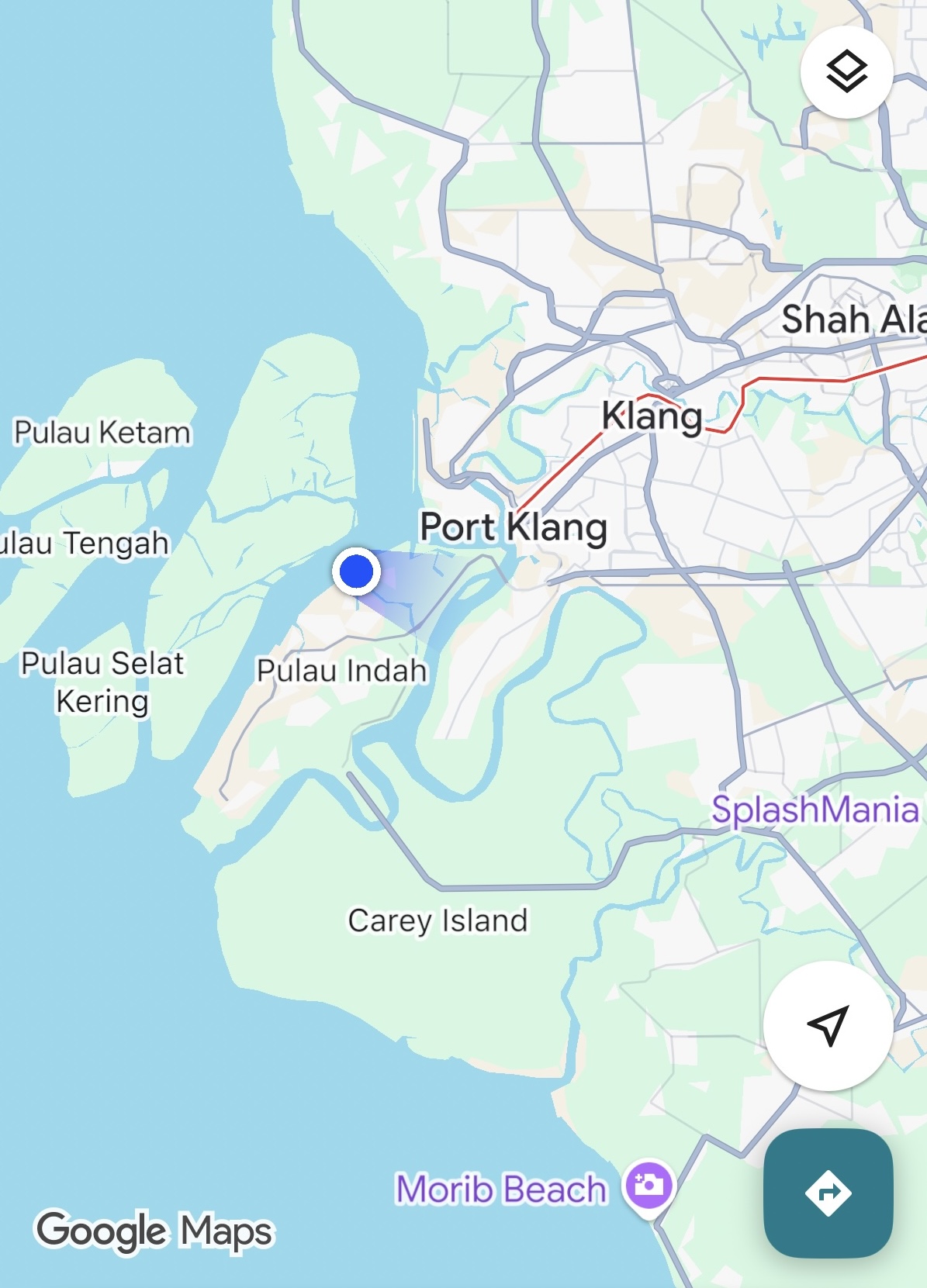

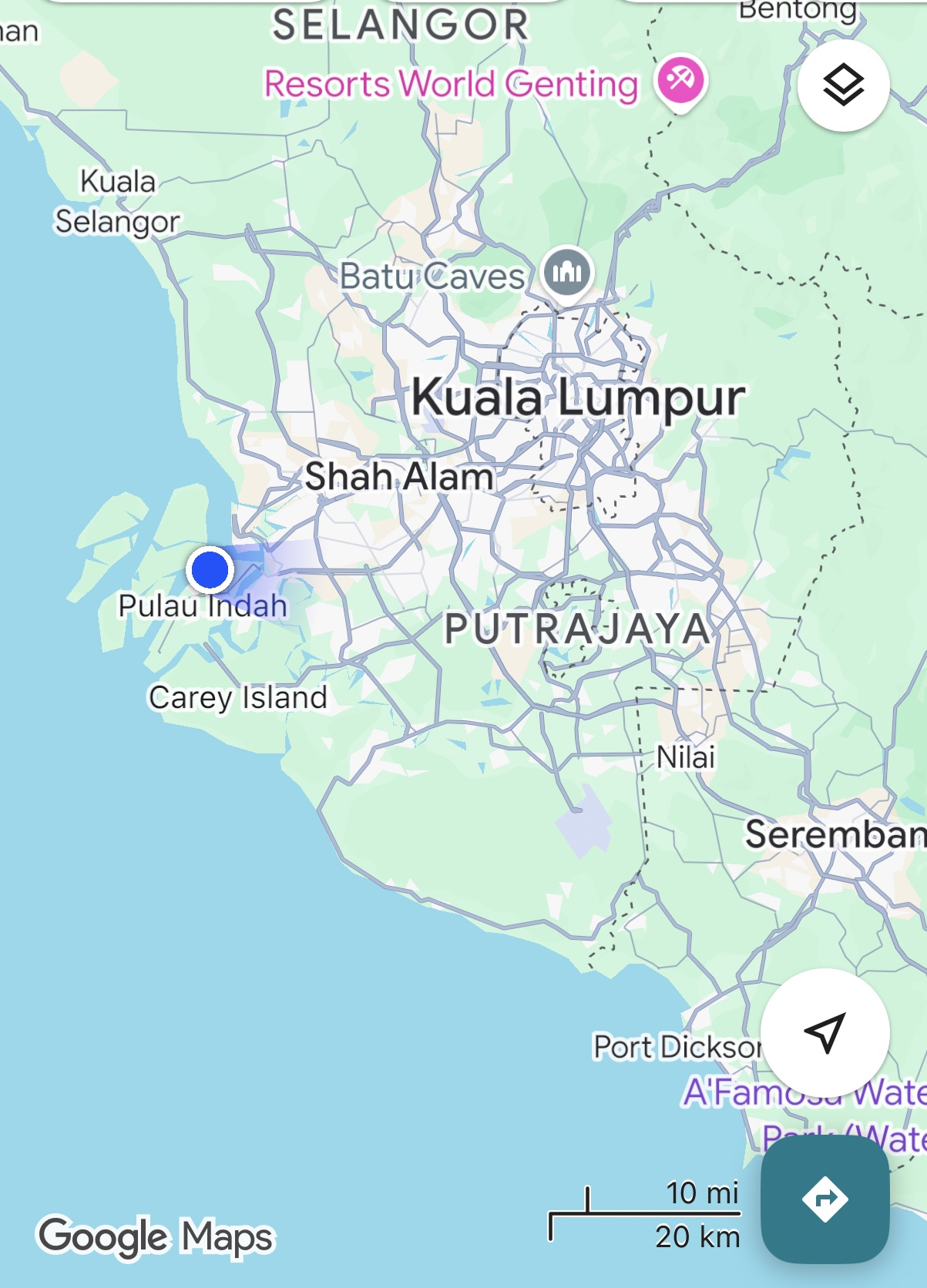

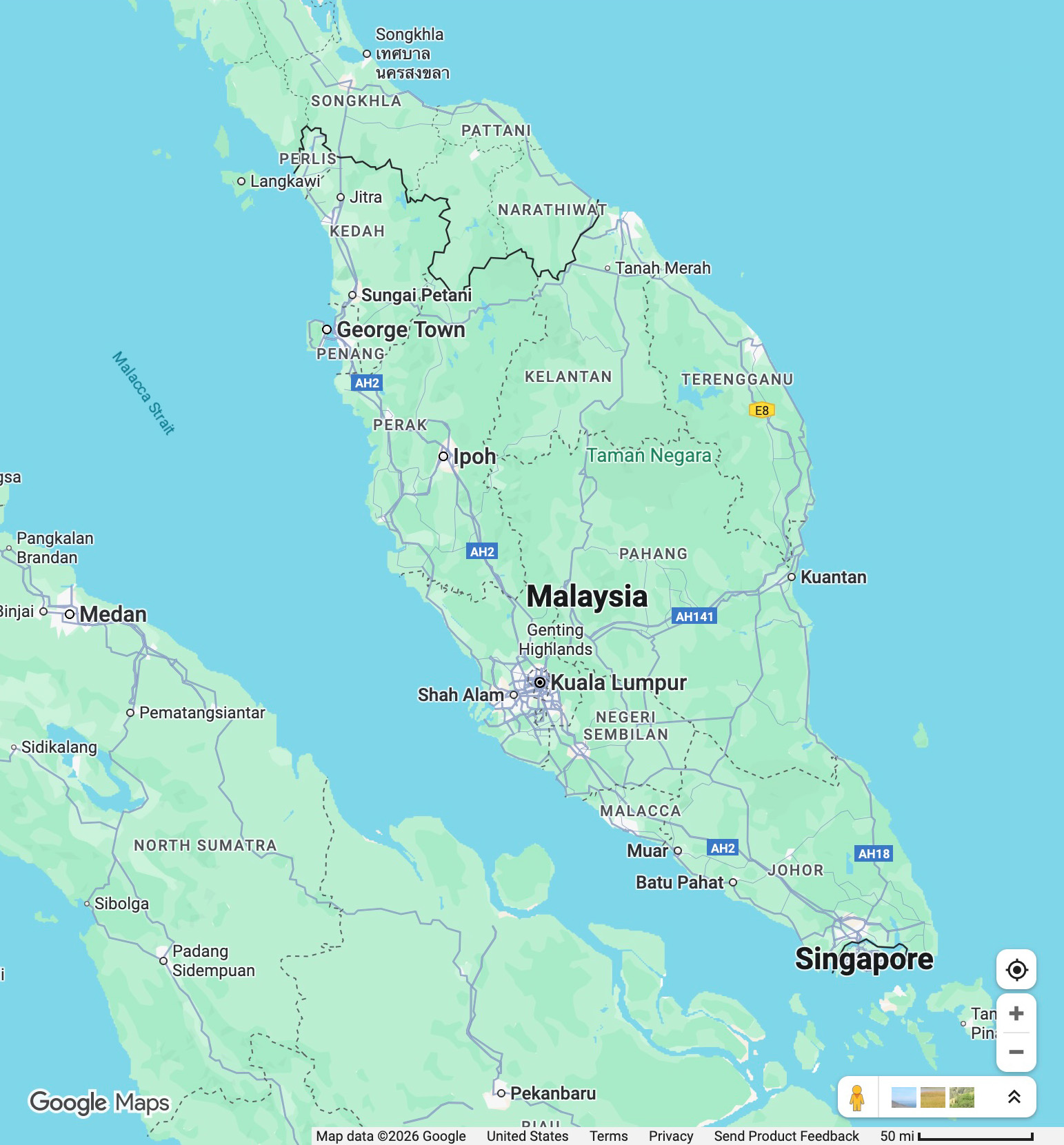

The Diamond Princess made it into her final port of call for this voyage this morning, arriving at Port Klang at 8 am.

I was well enough to take the shuttle bus to the AEON Bukit Tinggi Mall, 20 minutes away. That was a consolation prize, since I had cancelled my excursion into Kuala Lumpur, and the Petronas Towers 😢, two days before (not sure I would be well enough to do the whole-day excursion).

That ship in the distance, all the way across from our own terminal, sails under her new name Star Voyager, operated by StarCruises.

From Wikipedia:

She was built in 1997 and previously known as Dawn Princess and Pacific Explorer, having previously been operated by Princess Cruises and P&O Cruises Australia. In 2001, while operating in Alaska’s Glacier Bay National Park, Dawn Princess struck and killed a humpback whale while travelling too fast through the protected waters. Princess Cruises was later charged and found guilty in United States federal court and paid a fine and restitution totalling US$750,000.

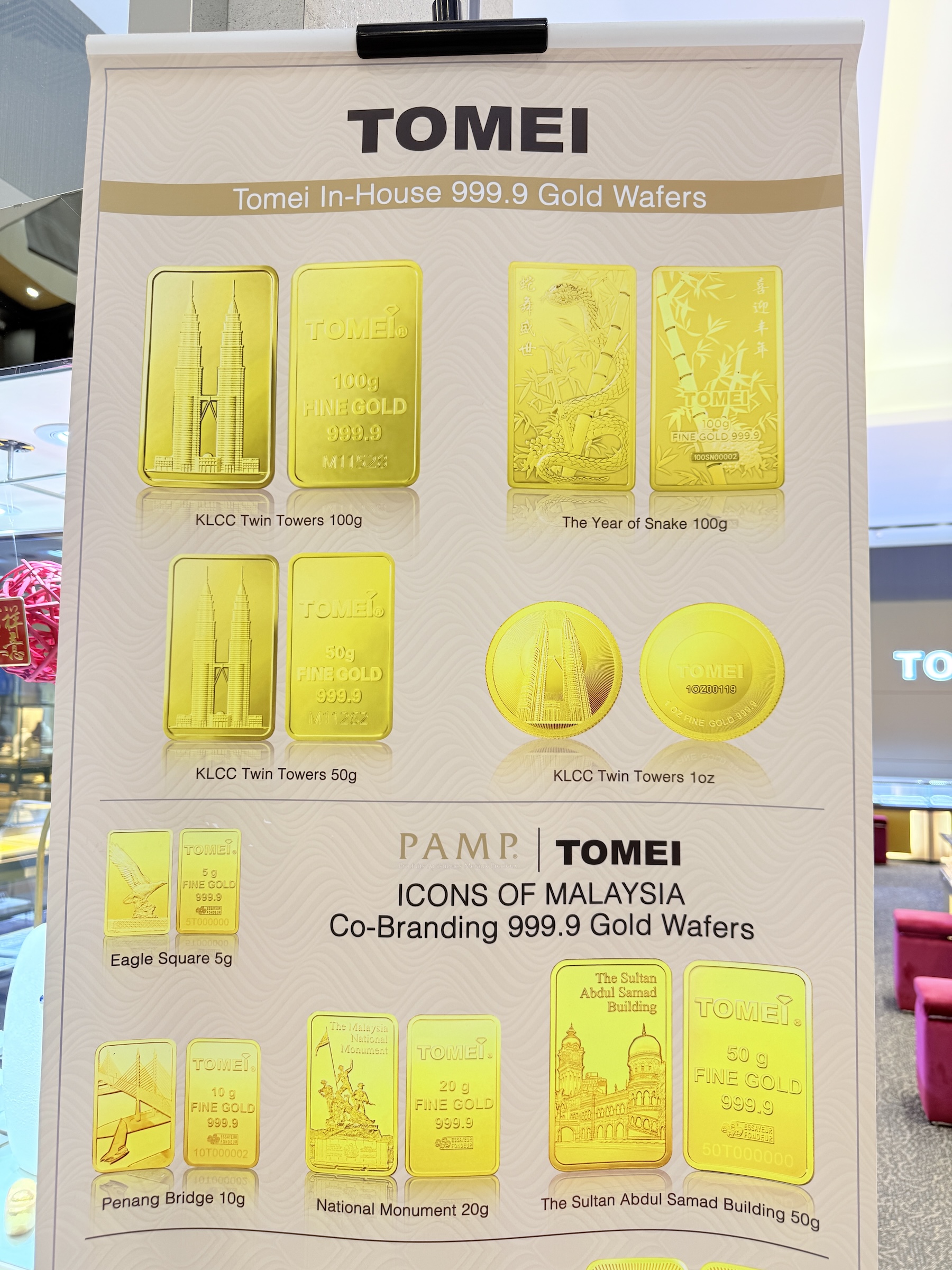

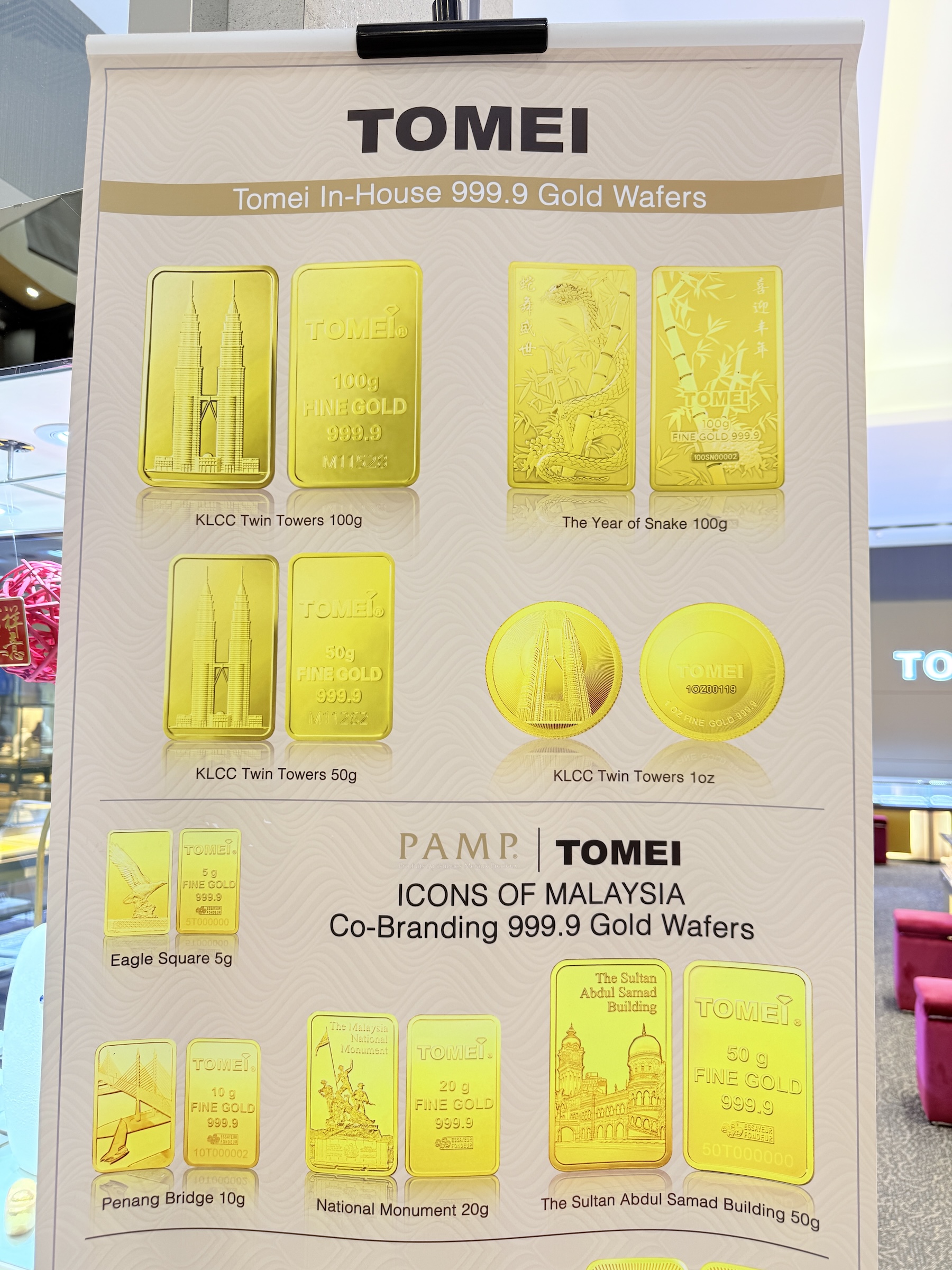

Looking at my mall pictures, I now regret I did not buy the little gold wafer with the Petronas Towers on.

Oppo is a Chinese tech company, known for its innovative Android smart phone designs, with strong camera features (often with Hasselblad tech), fast charging and competitive pricing.

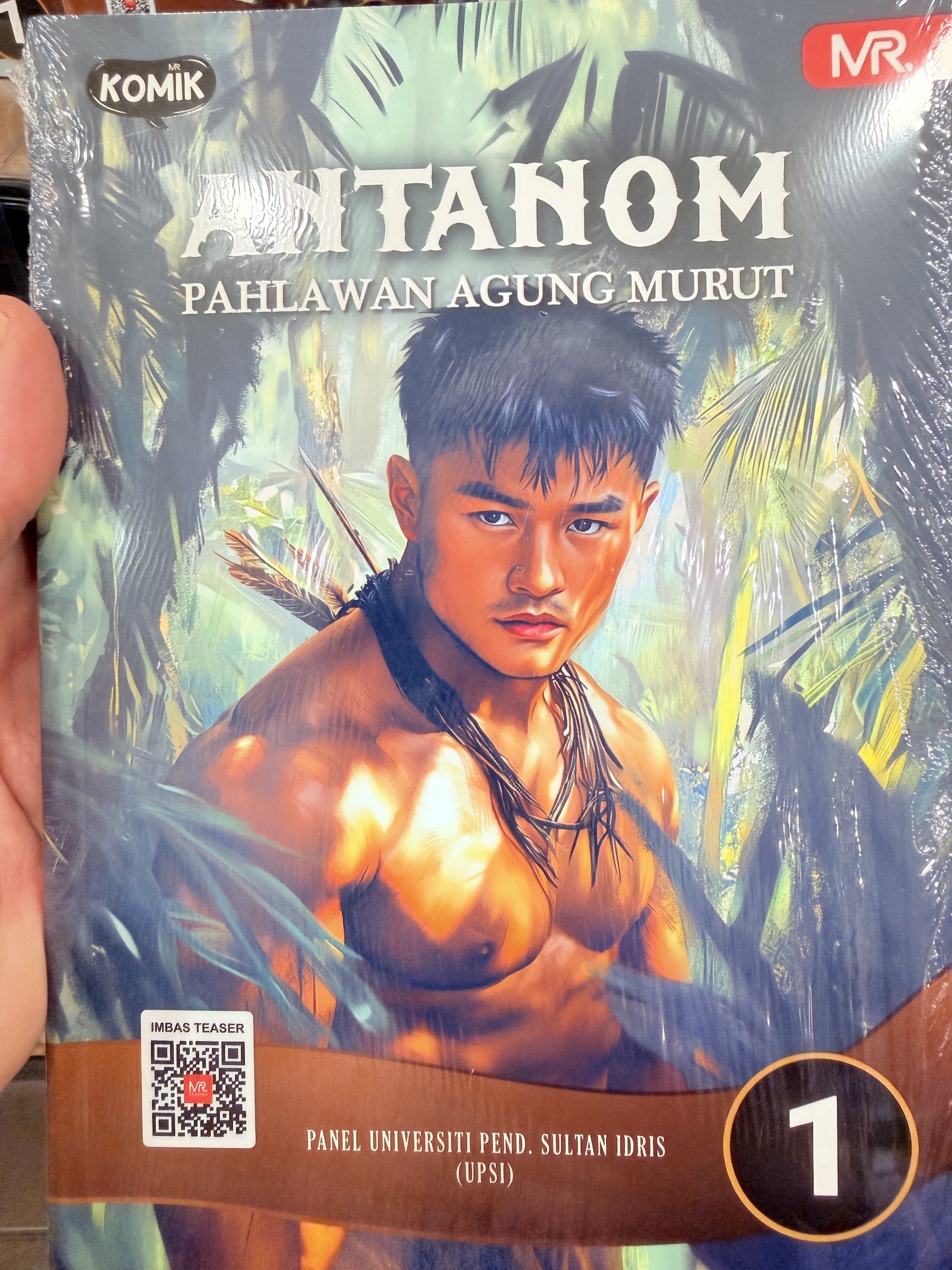

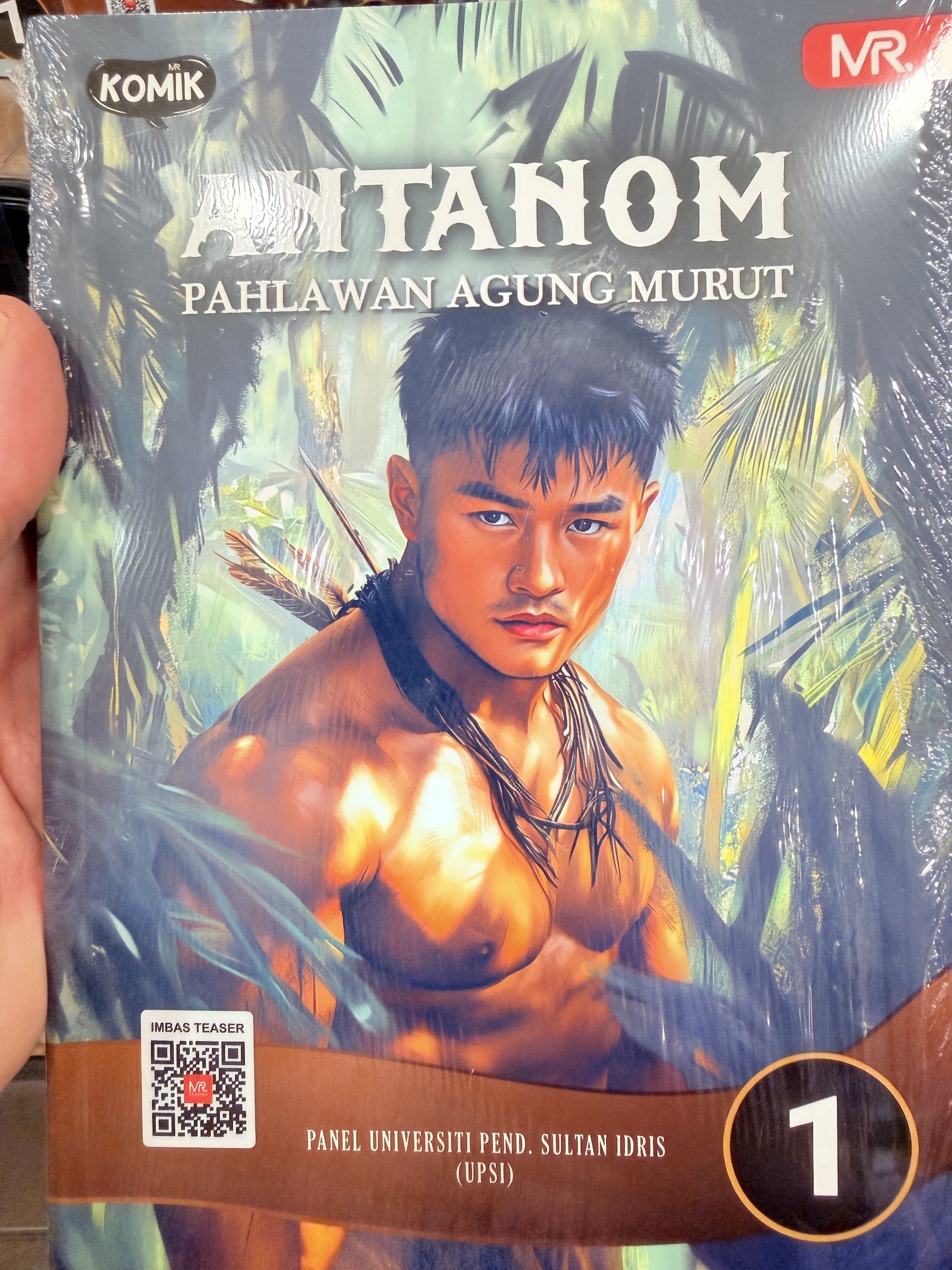

And the book? I should have bought that as well, but Amazon may be able to help me mend my mistake.

Google AI:

Antanom (Ontoros bin Endoi) was a renowned Murut hero from Sabah, Malaysia, who led an uprising against the British in Rundum in the early 1900s due to taxation and oppression. He is known as a great hero for his charisma, spiritual power, and ability to unite the warring Murut tribes against the colonizers, and he died in battle. His story has been immortalized in books and documentaries, solidifying his title as a hero of the Murut people.